Most contractors, lessors, mortgage holders, manufacturers and service providers are familiar with certificates of liability insurance. This is the document that displays the insureds name, insurer, type(s) of policy (or policies), effective and expiration dates, limits of insurance, certificate holders name, etc. Most contractors, lessors, mortgage holders, manufacturers and service providers are familiar with certificates of liability insurance. This is the document that displays the insureds name, insurer, type(s) of policy (or policies), effective and expiration dates, limits of insurance, certificate holders name, etc.

What I'm finding out is that most don't know how to determine if they're actually an additional insured or just a certificate holder.

Let's say you ask your tenant, artisan contractor, vendor, etc, to list you as additional insured on their policy. They send you a certificate with all the above filled in including your name as the certificate holder. Are you an additional insured?

No.

Why not, you ask?

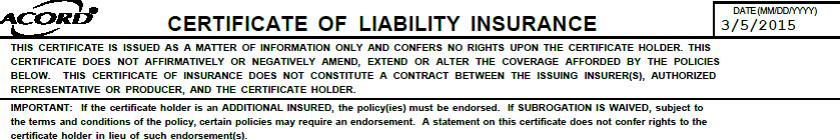

If you read the very top paragraphs (right under "Certificate of Liability Insurance" (accord 25 (2014/01), it states that "The certificate is issued as matter of information only and confers no rights upon the certificate holder (that's you)."

No rights? Yep, as in "additional insured" rights.

Continue reading on to the second paragraph, where it starts with the word "Important." Here it states that if the certificate holder is an additional insured (ah, now we're getting somewhere!), the policy must be endorsed (which means there has to be a written document stating you are an additional insured and it must be added to the policy; without it, you are not an additional insured).

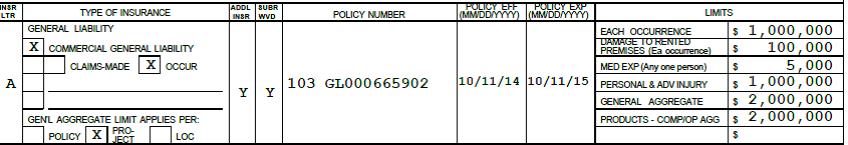

Hey, but what about if you receive the certificate and the little column saying "ADDL INSR" (in between the type of insurance and policy number columns) is checked? Are you an additional insured then? Isn't this enough?

No.

Why not you ask again? The checked box says I am, so I must be right?

Not necessarily.

Refer to the second paragraph discussed above again — the one that started with the word "Important."

It is clear on what must happen in order to be listed as an additional insured and it has nothing to do with a checked box. Again…remember, the certificate is for informational purposes only and conveys no rights to you as the certificate holder (no matter what it says).

In order to be sure you are listed as an additional insured, the policy must be endorsed (i.e. adding you as additional insured to the policy), so when requesting to be listed as an additional insured, be sure to obtain a copy of the endorsement.

Of course, even with the endorsement, are you now, finally, an additional insured?

Most likely yes — unless this involves a situation where the party you requested this endorsement from has completed their work for you. Then, without another specific endorsement (additional insured: Completed Operations) that continues to keep you as additional insured after their work has been completed is added to the policy, you may not be.

There's a lot to know and it's what you don't know that could get you into trouble — which is why you want to make sure you work with an educated, competent agent that you trust has your best interest in mind.

Let us help you navigate your insurance coverage. Call Southwest Commercial Insurance at (512) 771-6091 for more information on Austin general liability insurance.

Posted Tuesday, March 10 2015 2:00 PM

Tags : certificate of liability insurance, general liability insurance, forms, coverage, business insurance, commercial insurance, Austin, Texas, insurance, Austin TX insurance

|